This is the fourth in a series of findings of Data Decisions Group’s 2022 Medicare Preferences Study. Here, we review brand loyalty metrics for providers of Medicare Advantage coverage. In Article #5, we’ll look at the same information among the major providers of Medicare Supplement plans.

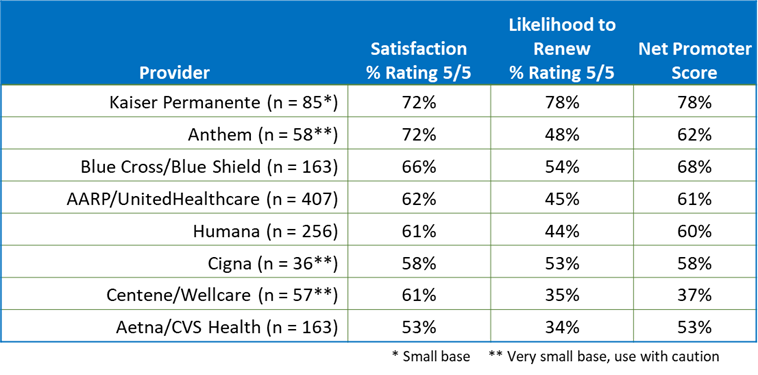

Despite its smaller market share, Kaiser Permanente leads Medicare Advantage providers with 72% of its members expressing complete satisfaction with the organization. Not coincidentally, Kaiser leads all providers in likelihood to renew, which we may define as “retention.” 78% of current Kaiser Permanente Medicare Advantage members say they’ll renew with that provider, which far exceeds the average retention rate of the other providers of 45%. Kaiser’s closest competitor is BCBS, with 54% retention rate. Finally, Kaiser boasts a Net Promoter Score of 78%; at around 60%, the NPS statistics for the category is high generally.

Aetna/CVS faces the highest churn risk among the major providers, as about 2/3 of its Medicare Advantage members indicate they may switch at their next opportunity. That provider also owns the lowest overall satisfaction while Centene/Wellcare’s Net Promoter Score ranks at the bottom among the major Medicare Advantage providers.

Members’ satisfaction with their Medicare Advantage coverage is directly and quantifiably related to their likelihood to renew with their provider. The correlation between overall satisfaction and likelihood to renew is about 58%.[1]

Data Decisions Group conducted the 2022 Medicare Preferences Study, a large, nationwide study of Medicare Advantage and Medicare Supplement alternatives among 2,324 current Medicare-qualified consumers and 64-year-olds who will become eligible soon. The online study was fielded between March 28 and April 11, 2022. The margin of error for this study is approximately ± 1.5%.

[1] Pearson r2 correlation = 0.577